GetMyInvoices

Modified on Tue, 13 Aug, 2024 at 10:47 AM

The GetMyInvoices modules allow you to watch, upload, retrieve, update, list, and delete the documents and companies in your GetMyInvoices account.

Prerequisites

A GetMyInvoices account

In order to use GetMyInvoices with Make, it is necessary to have a GetMyInvoices account. If you do not have one, you can create a GetMyInvoices account at getmyinvoices.com.

Notice

The module dialog fields that are displayed in bold (in the Make scenario, not in this documentation article) are mandatory!

To connect your GetMyInvoices account to Make you need to obtain the API Key from your GetMyInvoices account and insert it in the Create a connection dialog in the Make module.

1. Log in to your GetMyInvoices account and open your Dashboard.

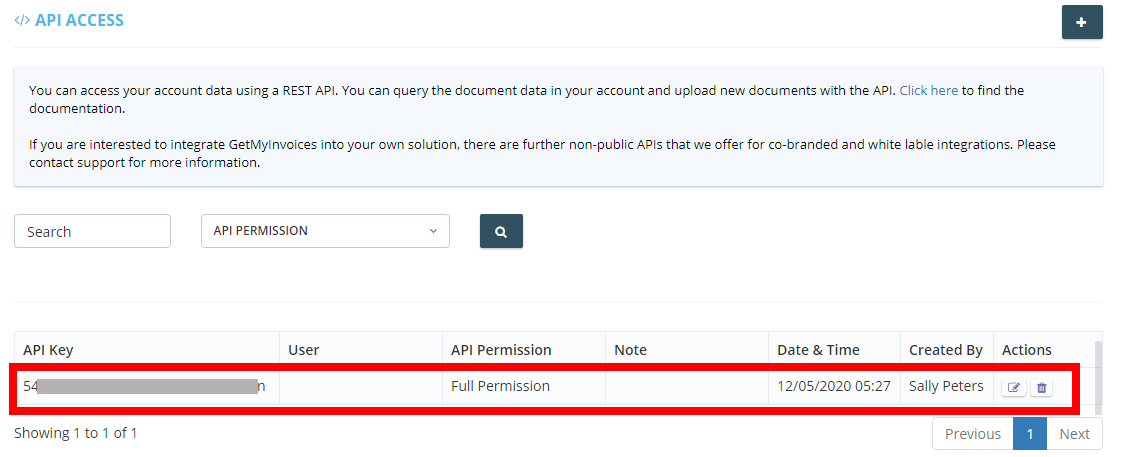

2. Click Your Profile Icon > API Access > Add API Key. Enter the details for API Key and click Save.

3. Copy the API Key to your clipboard.

4. Go to Make and open the GetMyInvoices modules Create a connection dialog.

5. In the Connection name field, enter a name for the connection.

6. In the API Key field, enter the API key copied in step 3 and click Continue.

The connection has been established.

Runs when a new document is added to the account.

Connection | |

Limit | Set the maximum number of documents Make should return during one scenario execution cycle. |

Runs when a new company is added to the account.

Connection | |

Limit | Set the maximum number of companies Make should return during one scenario execution cycle. |

Upload a new document to the account.

Connection | |

File Name | Enter a new name for the document. |

File Content | Enter the content details of the file. |

Document Type | Enter the document type. For example, |

Document Number | Enter the document number on the document. |

Document Date | Enter the date on which the document is created in the YYYY-MM-DD format. |

Document Due Date | Enter the date on which the document is due for payment in the YYYY-MM-DD format. |

Payment Method | Enter the payment method allowed. For example, |

Payment Status | Enter the payment status. For example, |

Net Amount | Enter the amount to be paid. |

Gross Amount | Enter the gross amount for the document. |

Currency | Enter the currency applicable. For example, |

VAT | Enter the VAT amount applicable to the invoice. |

Cash Discount Value | Enter the cash discount applicable to the invoice. |

Get one document from the account.

Connection | |

Document Prim UID | Enter the unique Document PRIM UID whose details you want to retrieve. |

Load Line Items | Select whether you want to retrieve line items related to the document. |

Readable Text | Select whether you want only the readable content from the document. |

Include Document | Select whether you want only basic data without the document content. |

Adds a new custom company.

Connection | |

Company Name | Enter a company name. |

Company Country | Enter the country in which the company is located. |

Company Tags | Add the tags for the company. |

Company Street | Enter the street address of the company. |

Company Zip | Enter the zip code of the region where the company is located. |

Company City | Enter the company's city name. |

Company Email | Enter the company's contact email address. |

Company Phone | Enter the company's contact phone number. |

Company Fax | Enter the company's fax number. |

Company Tax Number | Enter the company's tax number. |

Company VAT Number | Enter the company's VAT number. |

Company VAT ID | Enter the company's VAT ID. |

Company Commercial Register | Enter the company's registration number. |

Company IBAN | Enter the company's International Bank Account Number (IBAN). |

Company BIC | Enter the company's Business Identifier Code (BIC). |

Company URL | Enter the company's website URL address. |

Updates an existing custom company.

Connection | |

Company ID | Select the Company ID whose details you want to update. |

Company Name | Enter a company name. |

Company Country | Enter the country in which the company is located. |

Company Tags | Add the tags for the company. |

Company Street | Enter the street address of the company. |

Company Zip | Enter the zip code of the region where the company is located. |

Company City | Enter the company's city name. |

Company Email | Enter the company's contact email address. |

Company Phone | Enter the company's contact phone number. |

Company Fax | Enter the company's fax number. |

Company Tax Number | Enter the company's tax number. |

Company VAT Number | Enter the company's VAT number. |

Company VAT ID | Enter the company's VAT ID. |

Company Commercial Register | Enter the company's registration number. |

Company IBAN | Enter the company's International Bank Account Number (IBAN). |

Company BIC | Enter the company's Business Identifier Code (BIC). |

Company URL | Enter the company's website's URL address. |

Deletes an existing custom company.

Connection | |

Company ID | Enter the Company ID you want to delete. |

Gets a list of all the documents from the account.

Connection | |

Limit | Set the maximum number of documents Make should return during one scenario execution cycle. |

Get a list of all companies from the account.

Connection | |

Limit | Set the maximum number of companies Make should return during one scenario execution cycle. |

For more information, see GetMyInvoices API Documentation.

Was this article helpful?

That’s Great!

Thank you for your feedback

Sorry! We couldn't be helpful

Thank you for your feedback

Feedback sent

We appreciate your effort and will try to fix the article